6 Ways Forex Brokers Cheat You

Again, when trading Foreign Currencies on an OTC basis, the trader/customer will be dealing with institutions as principals and institutions may be subject to losses or insolvency. The potential exposure may be determined through probability analysis over the time to maturity of the outstanding position. The computerized systems currently available are very useful in implementing credit risk policies. In addition, the matching systems introduced in foreign exchange since April 1993, are used by traders for credit policy implementation as well. Traders input the total line of credit for a specific counter-party.

I totally agree that consulting a mentor like you is very much needed for traders like me. Good article, but I think that a person has to find himself in the forex market. Learning forex was the most difficult skill I have tried to learn. After learning so much in the forex market, spike trading is the best for me.

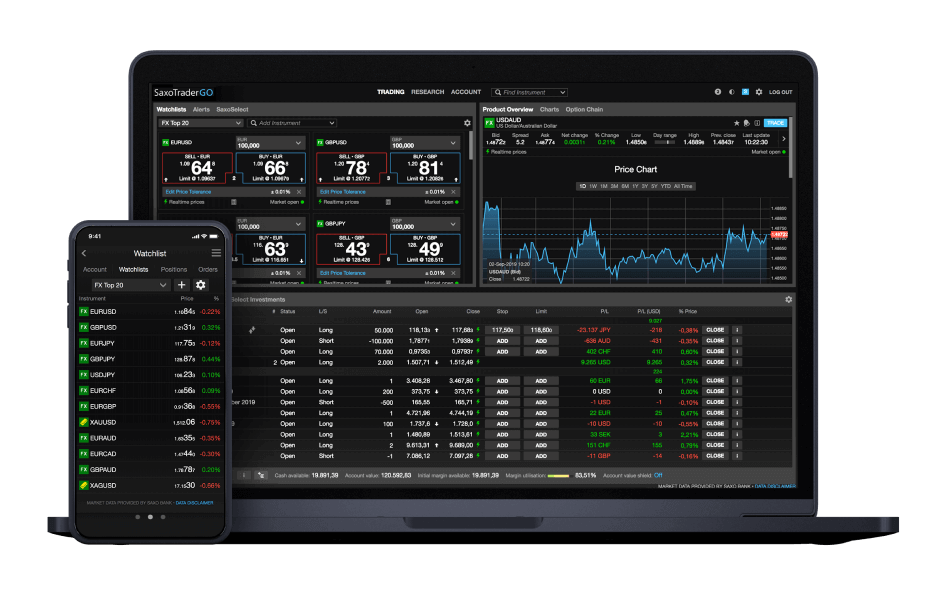

Whether you are in university or a seasoned trader, we are here to help. Email us your broker specific question and we will respond within one business day. Here’s a summary of the best forex trading platforms for beginners. Taken from our forex broker comparison tool, here’s a comparison of the education features for the best forex brokers for beginners.

NIAL FULLER Professional Trader, Author & Trading Coach

Traders can also consider using a maximum daily loss amount beyond which all positions would be closed and no new trades initiated until the next trading session. While traders should have plans to limit losses, it is equally essential to protect profits. While there is much focus on making money in forex trading, it is important to learn how to avoid losing money. Proper money management techniques are an integral part of successful trading.

Focusing your efforts on trading higher time frames will give you a much better perspective on the markets and will greatly reduce the amount of trading mistakes you make. The daily chart gives us the best combination of accuracy and frequency of price action trading setups. Meaning, you will get a much clearer, accurate, and more relevant view of a market’s price action on the daily chart than you will on any time frame below it.

They know that over 95% of the traders don’t know how to trade and they wipe out their accounts sooner or later. A higher leverage makes them take bigger positions, lose more and wipe out their accounts faster and easier. Slippage is normal with the real ECN/STP brokers, specially when the market is volatile and during the news release time, because ECN/STP brokers have to route your orders to the liquidity providers. Although this is done automatically and electronically, but it takes some time and it is possible that the price changes during this time, specially when the market is moving strongly.

It is all done automatically and through some special settings of the platform. They want you to open a live account before you learn to trade properly, and lose your money. Before the regulations, they were worried about you to lose your money to the overseas brokerages, but now it is OK if you lose, because your money goes to their own pockets now. The 10-inch screen means that you can pop this 2-in-1 in any kind of bag. You have options of 4GB RAM or 8GB Ram, which can be frustrating if you want to do more with your tablet than trade.

- Well, a poor attitude and a failure to prepare for current market conditions certainly plays a part.

- For example, Saxo Bank’s average spread was just 0.6 pips on the EUR/USD pair for the 30 days ending October 10th, 2019.

- The requirements for opening a Forex account have become simpler since the growth of online Forex trading.

- Traders input the total line of credit for a specific counter-party.

- Forex is gambling if you keep committing the mistakes that gamblers commit.

- The same can be said about currency pairs and commodities.

Strategies for Part-Time Forex Traders

Quite understandably, the first group tends to experience far more success in Forex trading because of their past experiences. You’ll need to fill out a brief questionnaire about your financial knowledge and trading intentions. You’ll also need to provide an ID, and the minimum deposit your Forex account institution requires. Incidentally, many forex brokers rating will take your credit or debit card in lieu of cash, so, you really don’t need to deposit any money at all—not that this is a good idea. If you don’t have the cash now, how will you pay for losses later?

These rates are not determined by your broker, but at the Interbank level. When trades are held overnight there is another cost that should be factored in by the trader holding the position. A commission is similar to the spread in that it is charged to the trader on every forex brokers rating trade placed. The trade must then attain profit in order to cover the cost of the commission. Commission in forex trading can either be a fixed fee – a fixed sum regardless of volume – or a relative fee – the higher the trading volume, the higher the commission.

Additionally, you also have to know about the brokers, the way they work and make money, and the way they can cheat their clients to make more money. eToro copy, a.k.a. CopyTrader, is a tool for social trading, which works by you copying the trading decisions of other people, or other people copying your trades. You can search for traders and other users, and see how their portfolio has performed historically. Once you found a trader of your liking, you can copy their every trading decision, which is handled automatically by the platform.

Such traders adopt high-volume, low-profit trading strategies, as they have little profit margins due to a lack of developments specific to forex markets. Instead, they attempt to make profits on relatively stable low volatility duration and compensate with high volume trades. Traders can also take long-term positions, which can last from days to several weeks. Forex trading can have very low costs (brokerage and commissions). There are no commissions in a real sense–most forex brokers make profits from the spreads between forex currencies.

Improperrisk management is a major reason why Forex traders tend to lose money quickly. It’s not by chance that trading platforms are equipped with automatic take-profit and stop-loss mechanisms. Mastering them will significantly improve forex a trader’s chances for success. Traders not only need to know that these mechanisms exist, but also how to implement them properly in accordance with the market volatility levels predicted for the period, and for the duration of a trade.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Yes, there are broker umarkets who offer no minimum deposit. So, you don’t need to deposit high amount to start trading. If you gain enough experience, you can trade with larger amounts.

There are dirty hands behind these kinds of apparently good actions (regulation). Indeed, they created a funnel to drain the funds to their own pockets. However, people just see the surface and are not aware of what is going on behind the scene. The conclusion is that “regulation” doesn’t necessarily mean that the broker can not cheat. Also not being regulated doesn’t mean that the broker cheats definitely.

It is imperative that you have stop loss orders in place. A position limit is the https://forexarticles.net/ maximum amount of any currency a trader is allowed to carry, at any single time.